In recent weeks, we have seen a sizable gains in funds allocated to equity investments in China, primarily through the Hong Kong stock exchange.

Announced tools to stimulate the economy led to a strong rise in stock prices in late September and early October. At one point, gains on the Hang Seng China Enterprises index exceeded those recorded by the world’s most important index, the S&P 500, which has also been shining triumphs of late and trading at historic peaks day after day.

However, considerable disappointment over the lack of new plans to support the economy means that gains on Chinese stocks have already been capped by nearly 15%. Does it still make sense to bet on increases in the Chinese stock market?

Chinese authorities have decided to take directional action regarding the real estate market. They have decided to cut a number of interest rates and to directly support banks, which would mobilize funds for loans or also allocate a certain amount of funds for stock purchases (primarily those companies related to the real estate market).

China’s problems, however, are rather structural and are not solely about the weakness of one sector. The problem is primarily that Chinese citizens no longer want to invest their funds in the real estate market and, just as importantly, they also have limited behavior for the stock market, so there is a growing desire to save through ordinary deposits.

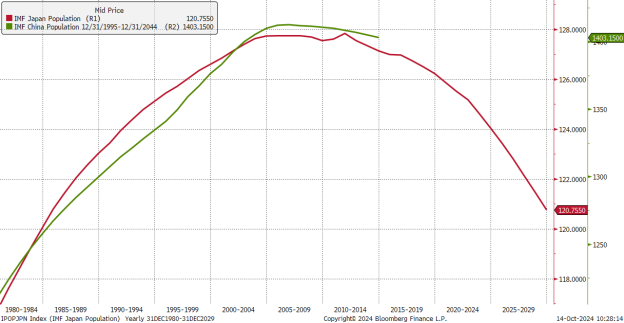

The number of vacant apartments for sale is now more than 60 million, and the number of square meters exceeds 700 million. This is a supply that, without the construction of new properties, would be enough for a 3-year sale. What’s more, it should be noted that more and more citizens will be depleted in the near future, as China is likely to follow the path set by Japan a dozen years ago.

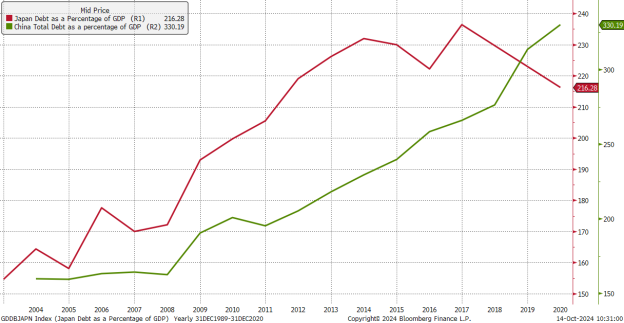

China also infamously boasts a far higher debt-to-GDP ratio, reaching over 300% in total and over 60% from a household perspective. In view of this, it is apparent that the recent plan presented, without a clear commitment of fiscal policy, may not be sufficient.

The supply of housing when viewed from the perspective of square meters currently exceeds 700 million in China. This would be enough for 3 years of sales, without taking into account the construction of new apartments. Source: Bloomberg Finance LP.

China’s debt now exceeds 300% of GDP. Source: Bloomberg Finance LP, XTB

In view of this, at this point, it seems that the current measures are another blowout that will not lead to a permanent improvement in the situation. Nevertheless, most likely this is not the end of the action and the authorities will try to improve the situation and meet their goals of achieving economic growth of 5% this year. There have been multiple reports that the government intends to issue 2 trillion yuan worth of bonds, which would be used to recapitalize banks, among other things.

The Hang Seng China Enterprises index has lost about 15% since this month’s peak and is already below its September close. From the perspective of the 2021 peaks, the index is losing about 40%, and from the perspective of the historic 2007 peaks, the index is trading near 70%. Chinese stocks are still very cheap, so with the announcement of the next support plan, a continuation of the current recovery cannot be ruled out. In the longer term, however, without action to address the structural problems, there is nothing to count on the increases we see on Wall Street, or even on Japan’s Nikkei 225. However, it also cannot be ruled out that the PBOC’s policy will follow in the footsteps of the Bank of Japan and include buying back shares through ETFs, which has been the basis for sustaining increases in the Japanese stock market for many years.

China may follow the Japanese scenario, given its declining population, which is obviously a very negative factor for the real estate market. Source: Bloomberg Finance LP

The Hang Seng CE is about 40% below its 2021 peaks. Despite the lack of a bright outlook for the economy, Chinese stocks are still cheap. Source: xStation5