Fast facts about FreshBooksStarting price: $19/month. Key features:

|

Our star rating: 4.1 out of 5

FreshBooks is an accounting, invoicing and billing software program designed for small businesses. All pricing plans support unlimited invoices, estimates and expense tracking, unlike some competitors that cap the number of invoices. The software does offer basic accounting features like receipt scanning and basic reports, but invoicing and billing are where it really shines. Businesses with more complex accounting needs may need to look at FreshBooks competitors such as QuickBooks.

In this article, I review FreshBooks’ pros and cons, explore its most important features and recommend comparable accounting software products that could work for you if FreshBooks doesn’t.

FreshBooks’ pricing

FreshBooks offers four pricing plans. The first three plans have transparent pricing and are designed to meet the needs of freelancers and small and midsize businesses. FreshBooks has an enterprise-level plan with customizable pricing and features, so you’ll have to contact the sales team for a pricing quote.

All FreshBooks plans come with a 30-day free trial, which doesn’t require a credit card. FreshBooks runs frequent sales that lock in deep discounts for your first six months; however, you must choose between the introductory discount and the free trial — you can’t have both. That being said, FreshBooks’ 30-day money-back guarantee ensures you won’t have to pay for the full six months if you decide FreshBooks doesn’t work for you within that first month.

| Plan details are up to date as of 6/14/2024. | ||||

FreshBooks Lite

Price: Starts at $19 per month

True to its name, the FreshBooks Lite plan offers basic features that are focused on invoicing. With this plan, you can send unlimited invoices and estimates to up to five clients. You can track unlimited estimates, but this plan doesn’t support mobile receipt capture. You can get paid via credit and ACH bank transfers and run reports at tax time, but that’s about it. If you need more features or want to bill more clients, you’ll have to upgrade to the Plus plan.

FreshBooks Plus

Price: Starts at $33 per month

The FreshBooks Plus plan lets you invoice up to 50 clients per month. This plan includes everything in Lite, plus the ability to set up recurring invoices and clients, automatically capture receipts and run financial and accounting reports. With this plan, you will be able to invite your accountant to the platform, which will be a big help come tax time.

FreshBooks Premium

Price: Starts at $60 per month

The FreshBooks Premium plan allows you to send unlimited invoices to unlimited clients, making it a suitable choice for midsize businesses. This plan includes everything in Plus, in addition to automatic bill capture, customizable email templates with dynamic fields and project profitability tracking.

FreshBooks Select

Price: Custom pricing only

FreshBooks Select is designed for larger businesses and enterprises. You must contact the sales team for a custom pricing quote. This plan includes everything in Premium, plus access to lower transaction fees, the ability to remove FreshBooks branding from emails and a dedicated number for exclusive support. This plan includes two team seats instead of just one.

Additional fees

FreshBooks users can add the following features for a fee:

- Extra users for $11 per person per month.

- Advanced payment acceptance for $20 per month (included with Select plan).

FreshBooks’s key features

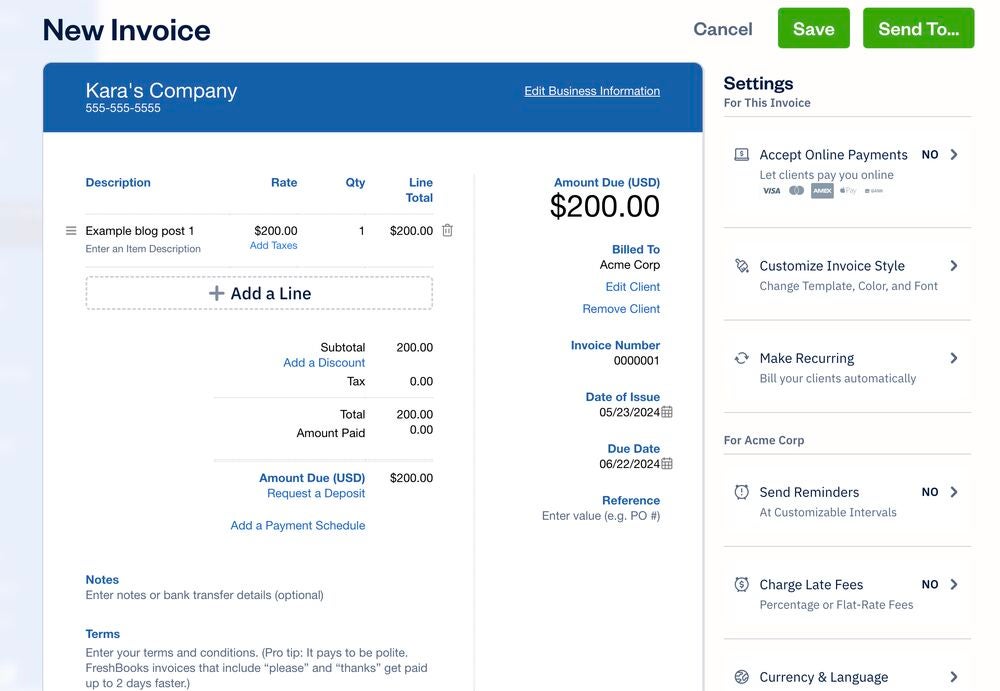

Unlimited invoicing and estimates

Every FreshBooks plan includes unlimited invoices — this sets it apart from Xero’s cheapest plan, which limits users to sending only 20 invoices a month. There are two templates to choose from, two fonts and a handful of colors. Personally, I would love to see more options than this limited selection to allow for greater customization, but it will suffice for most small businesses.

The process to create and send an estimate is equally simple, and you can convert it to an invoice with a single click after the client approves it. Additional invoicing features include automatic recurring invoices, automatic late fees for overdue invoices and automated upcoming-payment reminders.

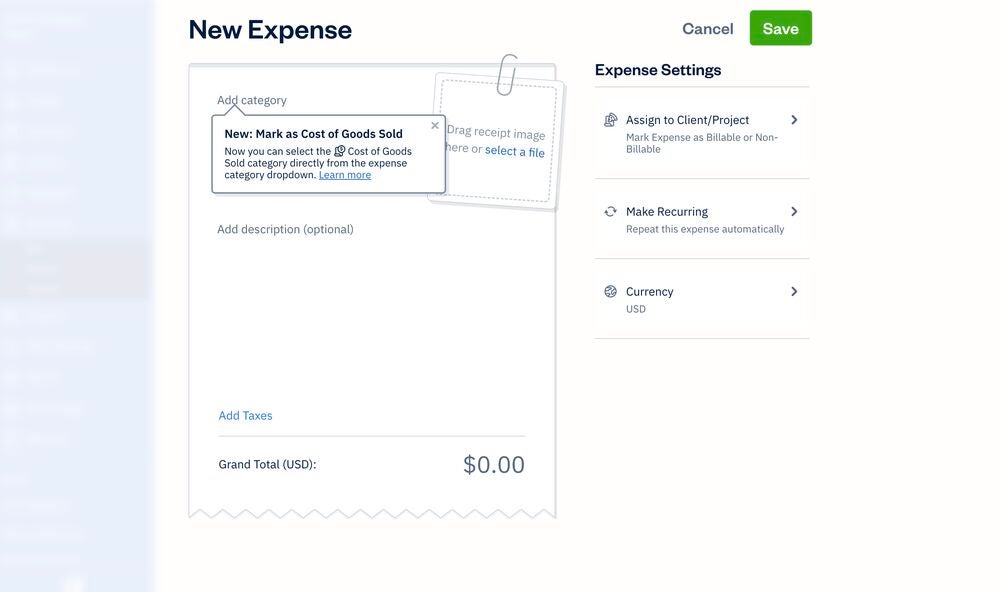

Expense tracking and categorization

FreshBooks syncs with more than 14,000 financial institutions and automatically imports your data through a secure 128-bit SSL encryption. You upload your expenses or capture them using the mobile app, then assign them to clients and attach them to invoices for reimbursement. The software will automatically categorize expenses to simply tax write-offs.

FreshBooks recently launched a new feature called Journal Entries, which allows you to track transactions outside of Invoices and Expenses, such as depreciation or loans. You must enable Advanced Accounting in order to be able to access the Journal Entries feature, so I only recommend using it if you’re familiar with slightly more complex accounting features.

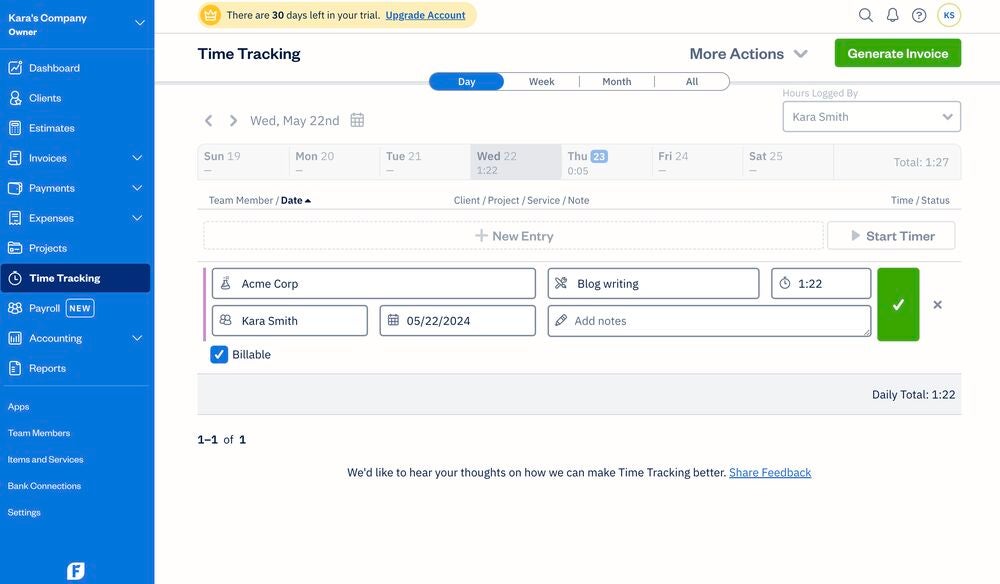

Time tracking

FreshBooks offers a native time-tracking feature so you can track billable hours and add line items to invoices. I found the timer very easy and intuitive to operate, and adding a time entry after the fact was super quick. All I had to do was choose the client, pick the date and add the service I was working on and the date I performed the work.

When you’re ready to bill your client, hit the big green Generate Invoice, and FreshBooks will walk you through the process. You can add time entries as line items right from the invoicing tool. As an employer, you can sort hours worked by client, team member, date and project to see how work time is being spent.

I love that FreshBooks offers this native time-tracking feature, unlike many competitors that rely on third-party integrations. However, the timer is pretty simple and doesn’t support advanced time tracking like entering particular billing codes for individual jobs.

Payment acceptance

Once you’ve sent the invoice, clients can pay you one of three ways: FreshBooks payments, Stripe and PayPal. All of these methods charge a standard fee of 2.9% + $0.30 per transaction for most cards and 1% for direct bank ACH transfers. Subscribers to the FreshBooks Select plan will get even lower transaction fees, but FreshBooks doesn’t disclose what that reduced rate is.

The optional Advanced Payments add-ons let your business accept credit card payments over the phone. It costs $20 per month for the three cheapest plans and is included on the Select plan. This feature also lets you set up recurring billing profiles for clients you work with regularly.

FreshBooks pros

- Built-in time and project tracking: All FreshBooks plans come with native time and project tracking, so you can sync the data straight to your invoices.

- Highly rated mobile accounting apps: With FreshBooks’ iOS and Android apps, users can create invoices, scan receipts and track mileage on the go. The iOS app scores 4.7/5 on the App Store, while the Android app rates 4.5/5 on Google Play.

- User-friendly interface: Both the mobile and web apps are user-friendly and intuitive, with setup only taking a few minutes.

- Payroll integration: FreshBooks offers an optional payroll add-on that is powered by Gusto, one of the most popular software options out there. You must contact the sales team for pricing information.

FreshBooks cons

- Cheapest plan limitations: FreshBooks Lite doesn’t include free accountant access, double-entry accounting or bank reconciliation, unlike many close competitors.

- Fee for additional users: Additional users for FreshBooks cost an extra $11 per person per month. For context, Zoho Books charges just $3 per extra user per month.

- Basic inventory tracking only: FreshBooks has only basic built-in inventory management features, though you can integrate it with some third-party integration tracking software.

- Limited scalability: Although FreshBooks offers a customizable plan for bigger businesses, its streamlined features work much better for small and midsize businesses. Its relatively limited selection of third-party integrations offers less flexibility for bigger companies.

Alternatives to FreshBooks

Xero: Best for product-based businesses

Our star rating: 4.4 out of 5

Starting price: $15 per month

Xero’s key features

Xero accounting software is designed for freelancers and small and midsize business owners. It offers simple tools for sending invoices, accepting payments and tracking finances. It works with Hubdoc, so you can upload bills and receipts for easier financial management.

Unlike FreshBooks, Xero includes inventory tracking with every plan. It lets you add as many users as you want at no additional cost, though each subscription is limited to one organization, so it’s not the best choice for business owners with multiple companies.

Xero’s pros

- Integration with more than 1,000 third-party apps.

- User-friendly software interface and mobile app.

- Automatic recurring invoicing.

- Bank reconciliation, accountant access and unlimited clients in all plans.

Xero’s cons

- Cheapest plan limits you to 20 invoices and five bills per month.

- Expense and project tracking only available in the most expensive plan.

- 24/7 support only available via live chat — no telephone number.

Learn more about how FreshBooks and Xero compare in our comprehensive analysis of FreshBooks vs. Xero, and read our Xero review.

QuickBooks Online: Best for growing businesses

Our star rating: 4.6 out of 5

Starting price: $30 per month

QuickBooks Online’s key features

Intuit QuickBooks Online is one of the most popular accounting software of all time. Its plans support businesses of all sizes, from self-employed freelancers and contractors to enterprises. With QuickBooks, you can track expenses, send an unlimited number of invoices per month, accept payments online and generate estimates.

QuickBooks Online has more bookkeeping and accounting features than FreshBooks, especially on the higher tier plans. If you’re willing to pay for them, QuickBooks’ more expensive plans offer advanced features like bill management, project profitability tracking and inventory management.

QuickBooks Online’s pros

- Accountant access, bank reconciliation and double-entry accounting.

- Mileage tracking, income tracking and tax categorization.

- Extremely scalable plans.

- Advanced accounting features available.

QuickBooks Online’s cons

- Much higher starting price than most competitors.

- Number of users limited on each plan.

- Poor customer service reputation.

Learn more about how QuickBooks Online and FreshBooks compare in our comprehensive analysis of QuickBooks vs. FreshBooks, and read our QuickBooks Online review.

Wave Accounting: Best free accounting software

Our star rating: 4 out of 5

Starting price: $0 per month

Wave’s key features

Wave Accounting is one of the only accounting software that offers a completely free plan. However, some of the most helpful features, such as automatic bank transaction import and mobile receipt capture, are limited to the Pro paid plan, which costs $16 a month.

Many of Wave’s features overlap with FreshBooks’, including its customizable invoicing tool, expense tracking and online payment expenses. Unlike FreshBooks, Wave uses double-entry accounting. With Wave’s paid plan, you can add an unlimited number of users and more thoroughly automate your income tracking.

Wave’s pros

- Free forever plan available.

- Helpful accounting app for both iOS and Android.

- Seamless integration with Wave Payroll.

Wave’s cons

- No inventory management, time tracking or project tracking.

- Limited third-party integrations.

- Less scalable than competitors.

Learn more about how Wave Accounting and FreshBooks compare in our comprehensive analysis of Wave Accounting vs. FreshBooks and check out our Wave Accounting review.

Review methodology

To evaluate FreshBooks, I set up a free account, viewed a demo and created invoices within the software as part of our hands-on test project. I carefully considered user reviews from trusted third-party sites. Features that I prioritized included invoicing, billing, expensive tracking, time tracking and payment acceptance. I considered pricing, ease of use and customer service during the writing of this review.