Investment portfolios across the UK no longer rely solely on equities and bonds. Investors now look for assets that behave differently under pressure and offer value beyond price movement on screens. Traditional goods have moved back into focus because they combine scarcity, physical ownership, and long-term demand.

This shift reflects fatigue with volatility and abstraction. Tangible assets change slowly. They age, mature, and respond to time rather than headlines. For investors seeking stability alongside growth potential, physical investments now play a strategic role rather than a marginal one.

Why UK investors are turning to alternative assets

Market behaviour since the financial crisis has reshaped risk perception. Sharp corrections, inflation pressure, and currency uncertainty have exposed the limits of conventional diversification within public equity markets. As a result, UK investors increasingly allocate capital to assets with lower correlation to public markets.

Alternative assets offer insulation from short-term shocks. Their value does not reset daily. They sit outside algorithmic trading cycles and speculative swings. This separation gives investors a form of structural balance, especially during periods of market stress.

Another driver is control. Tangible assets provide clear ownership and transparent progression. Investors can track condition, age, and storage rather than relying solely on price charts. This clarity has become a defining advantage for experienced capital holders.

Physical assets as a portfolio stabiliser

Tangible investments have demonstrated resilience during periods of financial uncertainty. Categories such as fine art, rare wine, vintage watches, and aged spirits have shown steady demand even when traditional assets declined during periods of market volatility.

These assets operate on long timelines. Supply constraints are fixed. Demand grows gradually through wealth expansion and global consumption trends. This combination limits sudden price collapse and supports gradual appreciation.

Liquidity differs from public markets, but this characteristic often works in favour of disciplined investors. Longer holding periods reduce reactive selling and encourage strategic planning. For portfolios built around capital preservation alongside growth, this structure adds stability.

Performance measurement in tangible investments

Returns in physical assets reflect long-term conditions rather than short-term market behaviour. Price movement depends on scarcity, quality, and timing, not on daily sentiment shifts. This dynamic separates tangible investments from assets driven by continuous trading.

Unlike publicly traded instruments, physical assets rely on layered evaluation. Condition, provenance, and buyer demand shape value over time. In this context, asset valuation functions as a professional discipline rather than an automated calculation, supporting pricing stability across longer holding periods.

Lower liquidity remains a defining feature. Sales processes take time, but this friction limits panic-driven correction. For investors with extended horizons, predictable pricing often outweighs the ability to exit instantly.

Supporting documentation underpins confidence. Verified ownership records, insurance cover, and condition reporting protect asset integrity and distinguish legitimate holdings from speculative exposure. These controls reinforce market trust and sustain value as assets mature.

Whisky casks as a strategic asset class

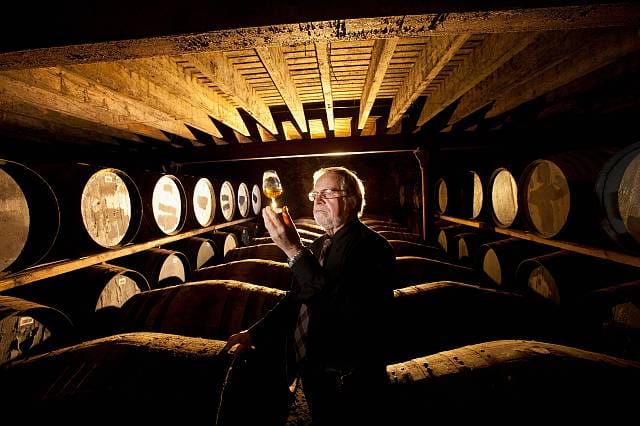

Among traditional goods, whisky casks occupy a distinctive position. They combine finite supply with a natural maturation process that adds value over time. Unlike bottled products, casks evolve continuously, influenced by wood, climate, and age.

Maturation drives both quality and market appeal. Chemical interaction between spirit and cask develops complexity, which buyers actively seek. Value growth tends to accelerate during extended ageing periods, especially once a cask reaches established maturity thresholds.

Several factors determine investment strength. Distillery reputation remains critical. Established producers command stronger demand and pricing power. Cask type also matters, with certain wood profiles preferred by bottlers and collectors. Limited releases and closed distilleries further tighten supply.

These variables shape profitable cask investment strategies when aligned with informed acquisition and patient holding.

Storage, maturation, and time horizon

Professional storage directly affects outcomes. Regulated facilities maintain stable temperature and humidity to support controlled maturation. Annual evaporation, commonly referred to as the angel’s share, reduces volume but contributes to flavour development and rarity.

Investment horizons typically range from five to twelve years, though longer holds often yield stronger premiums. Maturation cannot be rushed. Market demand favours age statements supported by verified storage and provenance.

During this period, alcohol content, flavour profile, and market positioning evolve together. Timing exits around optimal maturity points requires planning rather than reaction.

Regulation, tax, and due diligence in the UK

Whisky cask investments fall outside direct financial regulation but operate within UK consumer protection law frameworks. Industry standards and established brokers provide structure and accountability.

Tax treatment often classifies whisky casks as wasting assets, which can offer capital gains advantages. Individual circumstances vary, so professional advice remains essential.

Due diligence protects capital. Investors should confirm ownership records, storage contracts, insurance, and regular reporting. Unrealistic return projections and missing documentation signal risk rather than opportunity.

Independent verification strengthens decision-making and reduces exposure to poorly managed schemes.

Integrating whisky casks into a balanced portfolio

Financial planners often recommend allocating a controlled percentage of total capital to alternative assets. Whisky casks function best as part of a broader structure rather than a standalone focus.

Diversification within the category matters. Exposure across distilleries, cask types, and maturation stages spreads risk and smooths returns. This approach mirrors traditional asset allocation principles while working alongside exposure to established capital markets rather than replacing them.

Exit planning deserves early attention. Sales routes include private collectors, bottlers, and specialist brokers. Aligning exits with peak demand and maturity supports pricing strength and execution efficiency.

As global interest in premium whisky continues to rise, especially across Asian markets, long-term demand remains supportive. Investors who prioritise verification, storage quality, and disciplined timelines position themselves for steady performance rather than speculative swings.

Traditional goods have regained a clear role in modern investment portfolios as investors reassess risk, volatility, and long-term value. Whisky casks illustrate how physical assets can contribute stability, scarcity, and time-driven growth when integrated with discipline and proper verification. For investors seeking diversification beyond price-driven markets, tangible assets offer structure rather than speculation. In a climate defined by uncertainty, patience, documentation, and strategic allocation remain decisive advantages.

The above information does not constitute any form of advice or recommendation by London Loves Business and is not intended to be relied upon by users in making (or refraining from making) any finance decisions. Appropriate independent advice should be obtained before making any such decision. London Loves Business bears no responsibility for any gains or losses.